What is a REIT?

Submitted by Foothills Financial Planning on September 14th, 2014Have you ever wondered who owns the skyscrapers in America’s major cities? It’s not just Donald Trump. In fact, unless The Donald puts his name on it, chances are a REIT owns it. A REIT (rhymes with “tweet”) is simply a corporation that owns real estate. The acronym stands for Real Estate Investment Trust. Long before I was born, in 1960 to be specific, Congress created the REIT concept. According to the National Association of Real Estate Investment Trusts (NAREIT), President Eisenhower signed the REIT Act into law on September 14 of that year. The idea was to allow individual investors to buy commercial real estate in the same, diversified way that mutual funds allowed them (us) to buy stocks and bonds.

No Double Taxation Without REITpresentation

The thing that makes REITs different than some random corporation that owns real estate is that REITs must distribute at least 90% of taxable earnings to shareholders in the form of dividends. In so doing, they can deduct those dividends. Generally, corporations are taxed on their earnings, and any distributions to shareholders (dividends) are subject to taxation as income for the shareholder. This is commonly referred to as double taxation. Most REITs therefore pass on all of their earnings and avoid taxation at the corporate level altogether. There are other requirements to qualify as a REIT, but they’re kinda boring.

What do REITs own?

REITs can be classified by the types of investments they make. In broad terms, there are Equity REITs and Mortgage REITs. Equity REITs basically own and operate real estate. The vast majority of REITs are Equity REITs. Mortgage REITs essentially provide financing for entities that purchase real estate. They sometimes lend money directly to owners of real estate; alternatively, they may purchase mortgage-backed securities or other collections of loans.

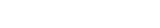

According to NAREIT, the Equity REIT universe is split in the following way. It may seem obvious that REITs would own office buildings and shopping malls, but they also own self storage facilities and timberland, among other things.

How do REITs perform?

Common stocks are generally held to be the best-performing broad asset class over “the long term”. While this is true, it is often surprising to see how well REITs have performed over time. As this chart from Morningstar indicates, REITs have clearly not been a drag on a diversified portfolio over the past forty years. In fact, while stocks were compounding at an annual rate of 10.5% from 1972 – 2013, REITS returned an annual average of 11.9%.

Should You Invest in REITs?

As with most potential investments, the answer to whether or not you should invest is based on your individual situation. In other words, it depends. To my way of thinking, the primary reasons to own REITs boil down to two things: income and diversification. Because they’re distributing substantially all of their earnings, REITs tend to pay high dividends relative to traditional corporations. This can be beneficial to retirees and others seeking income-producing investments.

The other aspect of REITs that I consider attractive is the fact that they provide diversification for a traditional stock and bond portfolio. Although in some years they’ve had stronger correlation with non-REIT stocks than others, they generally don’t move in a manner that is predictably similar to either stocks or bonds. In other words, there’s a good chance they’ll hold up okay when stocks drop.